When Does The Irs Update Refund Status

The current tax flavor is starting to feel as bumpy every bit the concluding with many tax filers reporting delayed refund payments due to IRS processing backlogs and reconciliation of catch-upwardly payments for stimulus checks (RRC) and advance child tax credit payments.

The estimated 2021-2022 IRS refund processing schedule below has been updated to reflect the official get-go of the current revenue enhancement season. It is organized by IRS' WMR/IRS2Go processing status. The dates are just calendar week ending estimates and should non be construed as official IRS payment dates. Y'all tin see refund FAQs and past taxation twelvemonth schedules for reference in the sections below.

Maximize your 2022 refund and tax breaks with TurboTax

According to the IRS in the latest revenue enhancement season, they received more than than 169 million individual returns and issued more 129.8 million refunds worth nearly $366 billion. The average refund was $2,815. These numbers are all expected to increase in 2022 due to the surge in tax filings to claiming missed stimulus payments and other/new government credits

Note that actual refund deposit dates could be much longer than shown in the refund schedule table below (the IRS says on average most refunds are "normally" processing by 21 days) if your return is pulled for boosted fraud/security checks, special treatment or manual reviews.

This is why some filers are seeing the "Return Processing Has Been Delayed Beyond The Normal Timeframe (Revenue enhancement Topic 152)" message.

To become the exact date of your refund payment check the IRS' Where is My Refund (WMR) tool/app. Run into this article for other reasons your refund payment may be delayed.

Stay In the Know: Subscribe via email and watch our YouTube channel for taxation season updates

When Will I Get My Tax Refund in 2022?

| Taxation Render Accepted by IRS (Status = Render Received) | If IRS Processing Completed Past (Status = Refund Approved) | Estimated Refund Payment Date via Direct Deposit (Status = Refund Sent) | Estimated Refund Payment Date via Paper Bank check |

|---|---|---|---|

| January 24th, 2022 | January 31, 2022 | February vii 2022 | Feb 19, 2022 |

| February one, 2022 | Feb 8, 2022 | February 11, 2022 | February 22, 2022 |

| Feb seven, 2022 | February 14, 2022 | February xviii, 2022 | February 28, 2022 |

| February xiv, 2022 | February 22, 2022 | February 24, 2022 (PATH Batch #1) | March seven, 2022 |

| February 21, 2022 | February 28, 2022 | March four, 2022 (PATH Batch #2) | March 14, 2022 |

| February 28, 2022 | March 7, 2022 | March 11, 2022 (PATH Batch #3) | March 21, 2022 |

| March seven, 2022 | March 14, 2022 | March eighteen, 2022 | March 28, 2022 |

| March 14, 2022 | March 21, 2022 | March 25, 2022 | April iv, 2022 |

| March 21, 2022 | March 28, 2022 | April i, 2022 | April eleven, 2022 |

| March 28, 2022 | April four, 2022 | April 8, 2022 | April eighteen, 2022 |

| April four, 2022 | Apr 11, 2022 | April 15, 2022 | April 25, 2022 |

| Apr 11, 2022 | April 18, 2022 | April 22, 2022 | May 2, 2022 |

| April 18, 2022 | April 25, 2022 | April 29, 2022 | May 9, 2022 |

| April 25, 2022 | May two, 2022 | May half-dozen, 2022 | May 16, 2022 |

| May 2, 2022 | May 9, 2022 | May 13, 2022 | May 23, 2022 |

| May 9, 2022 | May xvi, 2022 | May xx, 2022 | May 30, 2022 |

| May 16, 2022 | May 23, 2022 | May 27, 2022 | June 6, 2022 |

| May 23, 2022 | May 30, 2022 | June 3, 2022 | June xiii, 2022 |

| May 30, 2022 | June six, 2022 | June 10, 2022 | June xx, 2022 |

| June 6, 2022 | June xiii, 2022 | June 17, 2022 | June 27, 2022 |

| June xiii, 2022 | June xx, 2022 | June 24, 2022 | July 4, 2022 |

| June 20, 2022 | June 27, 2022 | July ane, 2022 | July eleven, 2022 |

| June 27, 2022 | July 4, 2022 | July viii, 2022 | July xviii, 2022 |

| July 4, 2022 | July 11, 2022 | July 15, 2022 | July 25, 2022 |

| July 11, 2022 | July 18, 2022 | July 22, 2022 | August 1, 2022 |

| July 18, 2022 | July 25, 2022 | July 29, 2022 | August viii, 2022 |

| July 25, 2022 | Baronial i, 2022 | August v, 2022 | August 15, 2022 |

| Baronial one, 2022 | August 8, 2022 | August 12, 2022 | August 22, 2022 |

| August 8, 2022 | Baronial 15, 2022 | August xix, 2022 | Baronial 29, 2022 |

| August 15, 2022 | August 22, 2022 | August 26, 2022 | September 5, 2022 |

| August 22, 2022 | August 29, 2022 | September 2, 2022 | September 12, 2022 |

| August 29, 2022 | September 5, 2022 | September 9, 2022 | September nineteen, 2022 |

| September 5, 2022 | September 12, 2022 | September 16, 2022 | September 26, 2022 |

| September 12, 2022 | September 19, 2022 | September 23, 2022 | October iii, 2022 |

| September 19, 2022 | September 26, 2022 | September 30, 2022 | October 10, 2022 |

| September 26, 2022 | Oct 3, 2022 | Oct 7, 2022 | Oct 17, 2022 |

| October 3, 2022 | Oct x, 2022 | October 14, 2022 | October 24, 2022 |

| October 10, 2022 | Oct 17, 2022 | October 21, 2022 | Oct 31, 2022 |

| October 17, 2022 | October 24, 2022 | October 28, 2022 | November 7, 2022 |

| October 24, 2022 | October 31, 2022 | November 4, 2022 | November xiv, 2022 |

| Oct 31, 2022 | November seven, 2022 | November 11, 2022 | November 21, 2022 |

| Nov vii, 2022 | November fourteen, 2022 | November 18, 2022 | November 28, 2022 |

| November fourteen, 2022 | Nov 21, 2022 | November 25, 2022 | Dec 5, 2022 |

| Nov 21, 2022 | November 28, 2022 | December ii, 2022 | December 12, 2022 |

| November 28, 2022 | December five, 2022 | December 9, 2022 | December nineteen, 2022 |

| December 5, 2022 | December 12, 2022 | Dec sixteen, 2022 | December 26, 2022 |

| Dec 12, 2022 | December 19, 2022 | December 23, 2022 | January two, 2023 |

| Dec 19, 2022 | December 26, 2022 | Dec 30, 2022 | January 9, 2023 |

| December 26, 2022 | January 2, 2023 | Jan 6, 2023 | January 16, 2023 |

| January 2, 2023 | January 9, 2023 | January 13, 2023 | Jan 23, 2023 |

| January 9, 2023 | January 16, 2023 | January 20, 2023 | January 30, 2023 |

Note that as in previous years, if you claimed the Earned Income Revenue enhancement Credit (EITC) or the Additional Child Revenue enhancement Credit (ACTC) your refund may take been delayed beyond the standard processing times shown below due to the PATH deed. This is to allow for fraud and dependent verification processing required by police force.

See more details in the section (or this video) below around the PATH act which has now lifted. Refund payments held up the PATH human activity are now processing in batches and the latest status should be bachelor by February 19th, with payments via direct deposit being made by March 1st (per the IRS).

The estimated tax season refund payment dates schedule is based on past refund cycles and IRS guidelines. It shows the engagement your refund volition exist processed and paid based on the week your return is accepted and approved past the IRS.

For those experiencing ongoing problems or delays with their refunds check out this article on "Why is it taking so long to get my refund." The IRS has said that telephone and walk-in representatives can enquiry the condition of your refund simply if it's been 21 days or more since yous filed electronically, more than vi weeks since you lot mailed your newspaper return or if the IRS tool Where'south My Refund? directs you to contact them.

You tin also see earlier updates from prior revenue enhancement seasons and the thousands of comments below this article around dealing with delayed tax refund processing issues!

And then stay tuned and subscribe to get the latest updates and helpful articles for the upcoming tax season. I also post regular Youtube video updates on tax related topics.

Help! My WMR condition bar has disappeared

As many folks have commented, the WMR tracker status bar may disappear or not be shown if your return falls under IRS review afterward it is received (Status Bar 1: Return Received) because boosted information is needed for your render.

This can happen even if you previously checked WMR and it showed the condition as "Return Received." An explanation or instructions volition be provided depending on the situation (eg PATH bulletin or Tax Topic 152 as discussed below)

But don't panic when this happens. The IRS however has your render simply things are essentially on concord until the IRS gets the additional information from you lot to continue processing your return . Yous volition either get directions on WMR or IRS2Go or the IRS volition contact you past mail. See more than in this video.

Follow the provided instructions and return any additional data ASAP to get your potential refund and reduce any further delays. Talk to your accountant, tax abet or tax professional person if yous are not articulate on what the IRS is asking for or you don't get an update afterwards 21 days.

Path Human action, Tax Topic 152 and 151 – Is My refund canonical & when to wait it (EIC or CTC claimants)

Two of the nearly mutual refund related messages showing up on the WMR tool after your tax render is submitted are the PATH bulletin and to Refer to Tax Topic 152.The PATH message on the WMR or IRS2Go app relates to the the Protecting Americans from Taxation Hikes Act (PATH Act of 2015) and is to notify you that the IRS is legally required to hold refunds claiming the EITC/ACTC for two to three weeks due to farther identity verification.

For the current tax season, the IRS has announced f y'all claimed the Earned Income Taxation Credit (EITC) or the Additional Child Taxation Credit (ACTC), you can expect to get your refund aroundMarch 1.

WMR, IRS2Go and your transcript should start updating your refund approving status from around February 19th, in one case the PATH act lifts. See more in this article on PATH act processing and this update video.

The PATH message does not mean your revenue enhancement render is done and your tax refund is approved. It merely means the IRS systems have identified y'all are claiming the (EITC) or the (ACTC) on your revenue enhancement return, and so further processing and payments related to your refund are held up for the statutory agree menses (3 weeks after the showtime of tax season).

Once the PATH restriction is lifted, the IRS volition procedure these returns and pay refunds per the above schedule. You may run across Tax code 570 with a Discover 971 lawmaking (IRS review adjustment) if your refund is adjusted for other reasons.

When yous run across the "Refer to Tax Topic 152"message it means your refund is being candy and the IRS is directing y'all its generic refund page for more data. There is non much you can exercise simply expect to see if the IRS finds any issues or requires further verification of your identity or items in your taxation return. Meet the diverse reader comments beneath on timing and their feel later on getting this and other WMR messages.

A Tax Topic 151bulletin simply means that you lot're getting a tax get-go which may result in your refund being less than you expected. The reason for this is that the federal authorities has "start" or deducted monies from your tax refund to encompass debts you lot owe other federal agencies. Meet this article to get more details on why your refund was offset.

Yous will get an official notice letter/report explaining the actual offset and adjustments to your tax return, and details on how to appeal this action – but likely information technology volition filibuster yous getting your refund.

While not great news, the silver lining here is that the IRS has processed your return and your adjusted refund (where applicable) should be on its style.

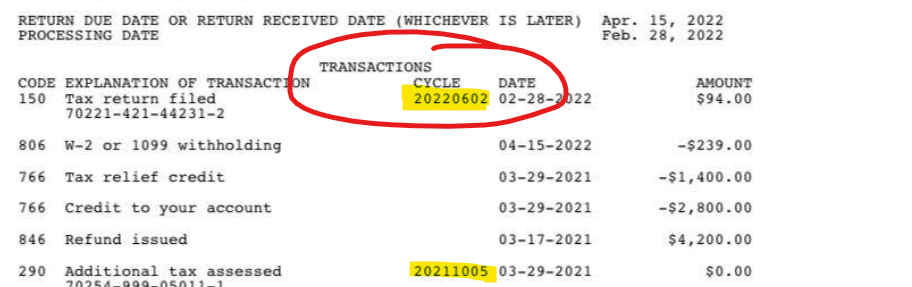

What is the IRS cycle code on my Transcript?

While the above IRS refund schedule can requite you an estimated engagement for you refund once canonical (WMR/IRS2Go condition) by the IRS, it may have a while to get at that place.

So some folks use their IRS tax transcript (complimentary from your IRS account) which shows diverse tax processing codes and a "bicycle lawmaking." This is an 8 digit number that indicates when your taxation return posted to the IRS Master File (Imf).

The cycle code is updated regularly and when combined with the tax topic code, can provide insight into your tax refund condition, processing stages and potential direct deposit date. You tin can run into a deeper discussion in this commodity.

If I can see current year processing details on my IRS tax transcript does it mean I am getting my refund before long?

This question comes up a lot and I have seen a few comments on this suggesting that that if you can meet current tax flavour processing details on your (free) transcript then your refund is on the fashion. But this is non a factual statement.

The IRS is very clear that just beingness able to come across processing details on your IRS transcript does not mean you lot will imminently be getting a refund and is amidst the common myths and misconceptions repeated in social media.

For the current tax flavor you transcript will update several times in line with your wheel lawmaking (discussed above) and IRS processing. The official IRS line is that checking the WMR or IRS2Go tool is the best and official way to check your refund status.

However I take read a number of comments here and on other tax sites saying that when WMR/IRS2Go provides limited information on the refund, your IRS transcript can be a good source to go more than details. The is particularly the case if your refund processing has been stuck for a while.

A annotation about IRS system bug and refund delays

It appears that the IRS is again having issues with processing returns in a timely way and so a number of people are seeing delays in getting their refunds or updates in the status of their refund on the WMR tool/app.

The IRS has said that all system issues havenow been resolved but given the diverse legacy systems they have and volume of processing, including prior season backlogs of paper and amended returns, I would not be surprised to see system problems arise once again this year, which hateful more delays in processing and paying refunds. See more around processing delays in this video.

See these articles for average refund amounts in past tax seasons and refund processing times by state

Amended Tax Return Refund Schedule

While the IRS promises to have regular render refunds candy within 21 days for 9 out of 10 tax payers, it does take quite a scrap longer to receive a refund if you amended your revenue enhancement return.

Generally y'all volition accept to await up to xvi weeks more for the IRS to process amended returns since they prioritize regular returns. Also note that the standard"Where's my refund" service from the IRS does not track amended taxation render condition'. You demand to instead use the IRS tool, Where's My Amended Return."

You lot tin also access the tool via phone past calling ane-866-464-2050. Only phone call the IRS to follow up on delayed amended return refunds afterwards 12 weeks. The number to call is 1-800-829-1040.

I will continue to update this article and encourage you to cheque dorsum regularly and subscribe via the options beneath.

________________________

2020 IRS Tax Refund Processing Schedule in 2021

| Showtime Engagement Tax Return Accepted by IRS (WMR status = Render Received) | IRS Refund Accustomed Week Ending Date (WMR status = Refund Approved) | Estimated Refund Date (via Straight Deposit) | Estimated Refund Engagement (via Newspaper Check) |

|---|---|---|---|

| February 12, 2021 | February 21, 2021 | March v, 2021 | March xix, 2021 |

| February 22, 2021 | February 28, 2021 | March 12, 2021 | March 26, 2021 |

| March 1, 2021 | March seven, 2021 | March nineteen, 2021 | Apr 2, 2021 |

| March 8, 2021 | March 14, 2021 | March 26, 2021 | April 9, 2021 |

| March 15, 2021 | March 21, 2021 | April ii, 2021 | April 16, 2021 |

| March 22, 2021 | March 28, 2021 | April 9, 2021 | April 23, 2021 |

| March 29, 2021 | April 4, 2021 | Apr 16, 2021 | Apr 30, 2021 |

| April v, 2021 | Apr xi, 2021 | Apr 23, 2021 | May seven, 2021 |

| Apr 12, 2021 | Apr 18, 2021 | Apr 30, 2021 | May xiv, 2021 |

| Apr 19, 2021 | Apr 25, 2021 | May 7, 2021 | May 21, 2021 |

| April 26, 2021 | May 2, 2021 | May xiv, 2021 | May 28, 2021 |

| May three, 2021 | May nine, 2021 | May 21, 2021 | June 4, 2021 |

| May 10, 2021 | May xvi, 2021 | May 28, 2021 | June 11, 2021 |

| May 17, 2021 | May 23, 2021 | June 4, 2021 | June 18, 2021 |

| May 24, 2021 | May thirty, 2021 | June eleven, 2021 | June 25, 2021 |

| May 31, 2021 | June 6, 2021 | June eighteen, 2021 | July two, 2021 |

| June seven, 2021 | June thirteen, 2021 | June 25, 2021 | July 9, 2021 |

| June fourteen, 2021 | June 20, 2021 | July 2, 2021 | July 16, 2021 |

| June 21, 2021 | June 27, 2021 | July 9, 2021 | July 23, 2021 |

| June 28, 2021 | July 4, 2021 | July xvi, 2021 | July thirty, 2021 |

| July five, 2021 | July 11, 2021 | July 23, 2021 | August vi, 2021 |

| July 12, 2021 | July 18, 2021 | July xxx, 2021 | Baronial xiii, 2021 |

| July 19, 2021 | July 25, 2021 | August half-dozen, 2021 | August 20, 2021 |

| July 26, 2021 | August i, 2021 | Baronial 13, 2021 | August 27, 2021 |

| August 2, 2021 | Baronial eight, 2021 | August twenty, 2021 | September iii, 2021 |

| August 9, 2021 | Baronial fifteen, 2021 | Baronial 27, 2021 | September x, 2021 |

| August 16, 2021 | August 22, 2021 | September 3, 2021 | September 17, 2021 |

| August 23, 2021 | Baronial 29, 2021 | September ten, 2021 | September 24, 2021 |

| Baronial 30, 2021 | September v, 2021 | September 17, 2021 | October 1, 2021 |

| September 6, 2021 | September 12, 2021 | September 24, 2021 | October 8, 2021 |

| September 13, 2021 | September 19, 2021 | October 1, 2021 | Oct xv, 2021 |

| September xx, 2021 | September 26, 2021 | October viii, 2021 | Oct 22, 2021 |

| September 27, 2021 | October 3, 2021 | Oct 15, 2021 | October 29, 2021 |

| Oct four, 2021 | Oct ten, 2021 | October 22, 2021 | November 5, 2021 |

| October 11, 2021 | Oct 17, 2021 | October 29, 2021 | November 12, 2021 |

| October xviii, 2021 | October 24, 2021 | Nov 5, 2021 | November xix, 2021 |

| October 25, 2021 | October 31, 2021 | November 12, 2021 | Nov 26, 2021 |

| November 1, 2021 | November 7, 2021 | Nov 19, 2021 | December 3, 2021 |

| November 8, 2021 | November fourteen, 2021 | Nov 26, 2021 | December ten, 2021 |

| November 15, 2021 | November 21, 2021 | December 3, 2021 | December 17, 2021 |

| November 22, 2021 | November 28, 2021 | Dec 10, 2021 | December 24, 2021 |

| November 29, 2021 | December five, 2021 | December 17, 2021 | December 31, 2021 |

| Dec 6, 2021 | December 12, 2021 | December 24, 2021 | Jan vii, 2022 |

| December thirteen, 2021 | December 19, 2021 | December 31, 2021 | January 14, 2022 |

| December xx, 2021 | December 26, 2021 | Jan 7, 2022 | January 21, 2022 |

| Dec 27, 2021 | January 2, 2022 | Jan 14, 2022 | January 28, 2022 |

| Jan 3, 2022 | January 9, 2022 | January 21, 2022 | Feb 4, 2022 |

[COVID-19 impact update] The IRS has announced, under the national emergency provision to tackle the Coronavirus, that they will postpone the April xv tax-payment borderline for millions of individuals, giving Americans an additional 90 days, to July 15, to pay file and pay their 2019 income-tax bills in an unprecedented motility intended to ease the economic pain inflicted by the coronavirus outbreak.

Further, because the IRS is now focused on paying out the 2020 economic stimulus payments and supporting the new UI stimulus measures in identify with other agencies, refund payments will likely be delayed well past the estimated dates shown in the table below. Many readers have reported this and while it is very frustrating, there is not much that can be washed given the economical fallout from the virus and soaring unemployment claims.

2019-2020 Taxation Refund Processing Schedule

| Tax Render Accepted by IRS After (WMR status = Return Received) | IRS Refund Approved (WMR status = Refund Approved) | Estimated Refund Date (via Direct Deposit) | Estimated Refund Appointment (via Paper Check) |

|---|---|---|---|

| January 27, 2020 | February two, 2020 | February 14, 2020 | Feb 28, 2020 |

| February 3, 2020 | Feb 9, 2020 | February 21, 2020 | March half dozen, 2020 |

| Feb 10, 2020 | February 16, 2020 | February 28, 2020 | March 13, 2020 |

| February 17, 2020 | February 23, 2020 | March half-dozen, 2020 | March 20, 2020 |

| February 24, 2020 | March 1, 2020 | March thirteen, 2020 | March 27, 2020 |

| March ii, 2020 | March 8, 2020 | March 20, 2020 | April 3, 2020 |

| March nine, 2020 | March 15, 2020 | March 27, 2020 | April 10, 2020 |

| March xvi, 2020 | March 22, 2020 | April three, 2020 | April 17, 2020 |

| March 23, 2020 | March 29, 2020 | April x, 2020 | April 24, 2020 |

| March 30, 2020 | April 5, 2020 | April 17, 2020 | May 1, 2020 |

| April half-dozen, 2020 | April 12, 2020 | April 24, 2020 | May 8, 2020 |

| April xiii, 2020 | April 19, 2020 | May 1, 2020 | May xv, 2020 |

| April 20, 2020 | Apr 26, 2020 | May 8, 2020 | May 22, 2020 |

| April 27, 2020 | May 3, 2020 | May xv, 2020 | May 29, 2020 |

| May 4, 2020 | May 10, 2020 | May 22, 2020 | June 5, 2020 |

| May 11, 2020 | May 17, 2020 | May 29, 2020 | June 12, 2020 |

| May eighteen, 2020 | May 24, 2020 | June 5, 2020 | June 19, 2020 |

| May 25, 2020 | May 31, 2020 | June 12, 2020 | June 26, 2020 |

| June 1, 2020 | June 7, 2020 | June 19, 2020 | July iii, 2020 |

| June viii, 2020 | June xiv, 2020 | June 26, 2020 | July 10, 2020 |

| June 15, 2020 | June 21, 2020 | July 3, 2020 | July 17, 2020 |

| June 22, 2020 | June 28, 2020 | July x, 2020 | July 24, 2020 |

| June 29, 2020 | July five, 2020 | July 17, 2020 | July 31, 2020 |

| July 6, 2020 | July 12, 2020 | July 24, 2020 | August vii, 2020 |

| July 13, 2020 | July xix, 2020 | July 31, 2020 | August 14, 2020 |

| July 20, 2020 | July 26, 2020 | Baronial 7, 2020 | Baronial 21, 2020 |

| July 27, 2020 | August 2, 2020 | Baronial xiv, 2020 | August 28, 2020 |

| August 3, 2020 | August nine, 2020 | August 21, 2020 | September 4, 2020 |

| August x, 2020 | August sixteen, 2020 | August 28, 2020 | September 11, 2020 |

| Baronial 17, 2020 | August 23, 2020 | September 4, 2020 | September 18, 2020 |

| Baronial 24, 2020 | August 30, 2020 | September 11, 2020 | September 25, 2020 |

| August 31, 2020 | September vi, 2020 | September 18, 2020 | October ii, 2020 |

| September 7, 2020 | September 13, 2020 | September 25, 2020 | Oct 9, 2020 |

| September 14, 2020 | September 20, 2020 | October ii, 2020 | Oct 16, 2020 |

| September 21, 2020 | September 27, 2020 | October ix, 2020 | October 23, 2020 |

| September 28, 2020 | Oct four, 2020 | October xvi, 2020 | October xxx, 2020 |

| Oct 5, 2020 | Oct eleven, 2020 | October 23, 2020 | November 6, 2020 |

| October 12, 2020 | Oct eighteen, 2020 | Oct thirty, 2020 | November 13, 2020 |

| Oct 19, 2020 | Oct 25, 2020 | Nov 6, 2020 | November 20, 2020 |

| October 26, 2020 | November 1, 2020 | Nov 13, 2020 | November 27, 2020 |

| November 2, 2020 | November 8, 2020 | November xx, 2020 | December 4, 2020 |

| November nine, 2020 | November 15, 2020 | Nov 27, 2020 | December 11, 2020 |

| November xvi, 2020 | November 22, 2020 | December iv, 2020 | December 18, 2020 |

| Nov 23, 2020 | Nov 29, 2020 | Dec 11, 2020 | Dec 25, 2020 |

| November xxx, 2020 | December 6, 2020 | Dec 18, 2020 | January one, 2021 |

| December seven, 2020 | December thirteen, 2020 | December 25, 2020 | Jan 8, 2021 |

| Dec 14, 2020 | Dec 20, 2020 | Jan 1, 2021 | January fifteen, 2021 |

| December 21, 2020 | Dec 27, 2020 | Jan viii, 2021 | January 22, 2021 |

| December 28, 2020 | January 3, 2021 | January fifteen, 2021 | Jan 29, 2021 |

| January four, 2021 | January 10, 2021 | January 22, 2021 | February 5, 2021 |

The federal IRSrefund schedule table below is only for electronically filed returns (e-file) washed thorough online revenue enhancement software providers and assumes your tax return was in order. I.e accustomed by the IRS via the WMR tool and status is equal to "Return Received". Paper filed returns tin can take considerably longer and would add 1 to 2 weeks to the time frames below.

As well notation that it could take much longer to get your refund if the IRS deems your tax render submission needs further reviews or your identity needs to be verified. This would add two to nine weeks to the date range of your refund delivery date.

The WMR tool volition also provide an bodily refund appointment equally before long as the IRS processes your tax return and approves your refund. If your refund is taking much longer than the higher up schedule, and bold your return was accepted past the IRS, please leave a comment below for the benefit of other readers. I tin can endeavour digging into the reasons if a few people are seeing delays.

Subscribe via email or follow united states of america on Facebook, Twitter or YouTube to get the latest news and updates

Source: https://savingtoinvest.com/irs-refund-schedule-and-direct-deposit-cycle-chart-for-tax-return-filings/

Posted by: hughesbuttept.blogspot.com

0 Response to "When Does The Irs Update Refund Status"

Post a Comment